Financial institutions aren’t seeing ROI on technology spend without standardized and automated development environments

Financial institutions such as commercial, retail, and investment banks, wealth management firms, and private equity firms used to be slow adopters of technology, prioritizing perceived stability and risk mitigation over innovation. However, this trade-off between innovation and risk is no longer observed, as adopting technology doesn’t come at the expense of risking security. This is evident in reports showing that banks now have the highest IT spending budgets compared to other industries.

Yet this increased tech spending isn’t generating the expected returns. Analyst reports indicate that financial institutions aren’t seeing the ROI they anticipated.

Challenges with technology in financial institutions

The financial sector has unique demands and constraints, with security and compliance always being top priorities. Traditionally, banks believed that building custom software was the only way to achieve the functionality, security, control, and stability they needed. However, recent analyst research highlights a shift from this ‘build over buy’ approach. Banks now allocate over 70% of their tech budgets to automation, AI, developer productivity enhancements, blockchain, and other technologies. Despite this, even between the highest tech spenders and lowest tech spenders, research shows us that banks are seeing less than 45% return on their tech investments.

This reveals several potential issues:

Banks made incorrect initial investment decisions

Banks didn’t consider ‘day 2’ overhead

According to research, ‘day 2’ overhead is the biggest contributor to the lack of return on investment. Let’s dig into why.

Banks and NBFIs that don’t consider ‘day 2’ overhead will never see ROI on tech investment

‘Day 2’ overhead refers to the operations and maintenance expenses of software. This sneaky cost often gets overlooked in initial ROI calculations, especially among banks not used to buying rather than building. Solving ‘day 2’ issues requires evaluators to be thoughtful about the software’s deployment model–whether self-hosted, self-managed, vendor-managed or vendor-hosted. Almost all banks will require a self-hosted solution and assume that, because they have chosen self-hosted, they must also self-manage. This is a misconception; self-managed software is the largest contributor to ‘day 2’ overhead for purchased technology.

The better alternative is to look for self-hosted and vendor-managed solutions that check the box on security requirements without the operational burden. This is especially true for platforms that automate and standardize development environments.

While the deployment model is the most straightforward way to address ‘day 2’ overhead, other factors also affect low ROI:

Not leveraging ‘platform as a product’ thinking

Over focusing on ‘outer loop’ solutions, neglecting the ‘inner loop’

Banks should shift to platform as a product thinking

Many financial institutions now turn to platform engineering to centralize technology efforts, drive cost improvements and automate processes. Unlike traditional IT and DevOps, platform engineering provides self-service solutions that developers can use without manual interventions. These platform teams integrate security and compliance, and create a ‘golden path’ for development teams to follow.

However, platform teams who don’t integrate an adequate ROI analysis in prioritizing work can contribute to ‘day 2’ challenges or lagging platform adoption. Platform as a product thinking aims to solve this. It’s a mindset shift that focuses on user-centric, business-centric solutions rather than simply delivering infrastructure. Moving to this model allows solutions to be designed with a focus on needs and pain points, rather than ‘throwing solutions over the wall’.

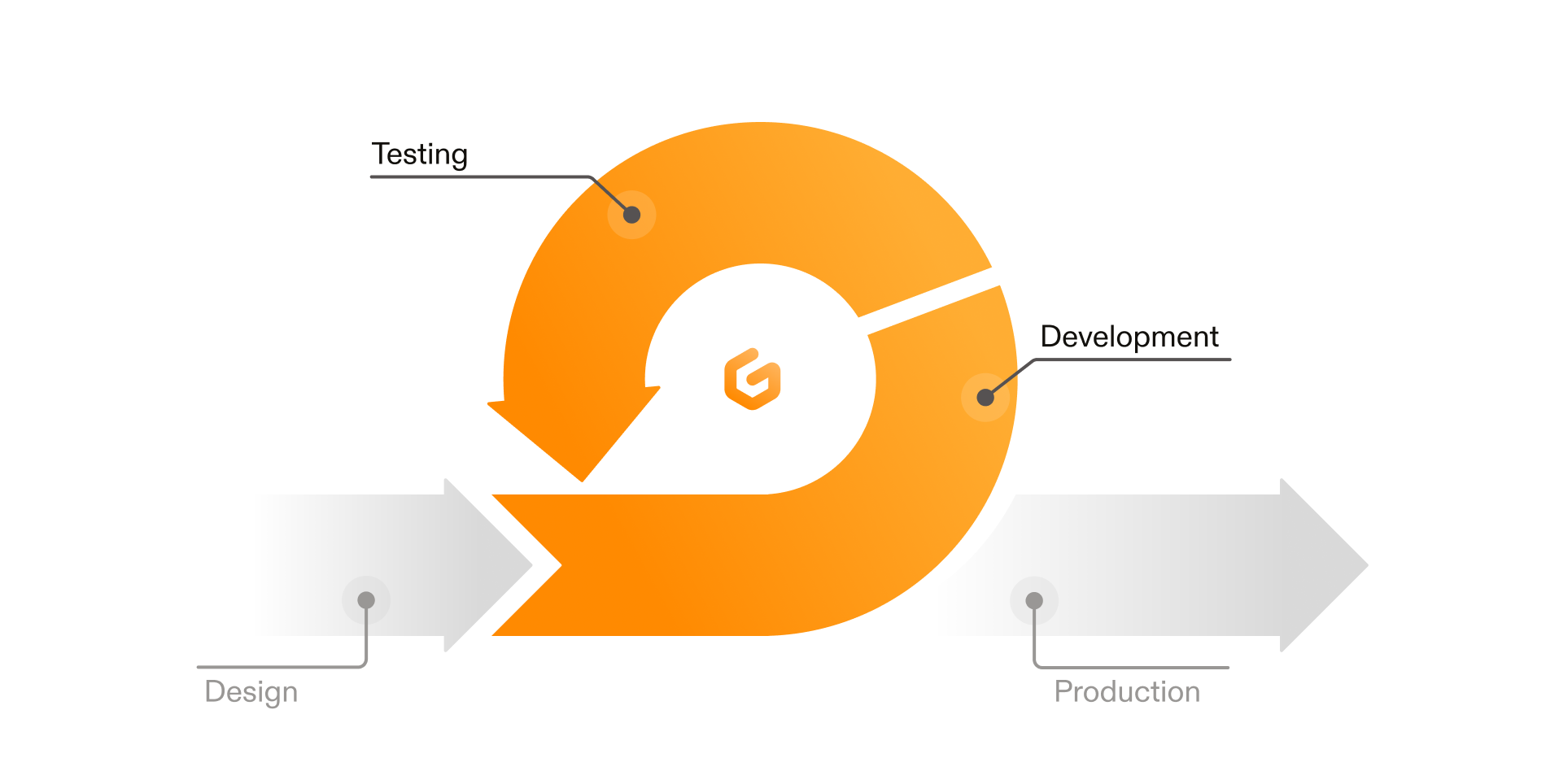

Additionally, platform teams have historically only been able to focus on ‘outer loop’ solutions. The ‘outer loop’ refers to everything a developer does that follows committing code to source control, such as continuous integration tooling, deployment or monitoring solutions. However, ‘outer loop’ solutions have an ROI ceiling. Developer productivity is achieved by keeping developers in a flow state, not by pushing developers to use, learn and adopt additional tools that are outside their existing workflows.

Taking control of the inner loop

The inner loop includes the cycles that happen before that process – writing and testing code.

By shifting focus to the inner loop, platform teams can deliver capabilities directly to developers, embedding new tools in their workflows and controlling the platform team’s ability to drive higher ROI.

Why banks should standardize and automate development environments

Standardizing and automating development environments ensure that developers always have an out-of-the-box development environment integrated with the latest platform tooling and security updates. Gitpod’s platform is exactly that and solves for the following problems:

Consistency and reliability: eliminates ‘works on my machine’ issues with uniform configurations and dependencies.

Improved security posture: pre-configured environments adhere to security and compliance policies, making secure practices easy for developers.

Increased developer productivity: reduces manual configuration efforts, maintaining environment setups, speeding up development cycles.

Onboarding efficiency: developers can start contributing on day 1.

Automated access controls: access controls are configured similar to a Google group, and can be changed from a single place to onboard or offboard easily.

Financial institutions must recognize that increasing technology spending alone will not yield the expected returns without addressing underlying inefficiencies. The biggest challenge lies in ‘day 2’ overhead costs, which can be helped with shifts in practice like platform as a product thinking and supporting the inner loop, both of which can be immediately supported by automating and standardizing development environments.

Gitpod is a self-hosted, not self-managed solution for automated and standardized development environments, often described as ‘the goldilocks solution’. Gitpod’s unique deployment model ensures banks have no ‘day 2’ overhead while checking the box on all security and compliance requirements. Gain insights into how your organization can increase ROI on tech spend using automated and standardized development environments.